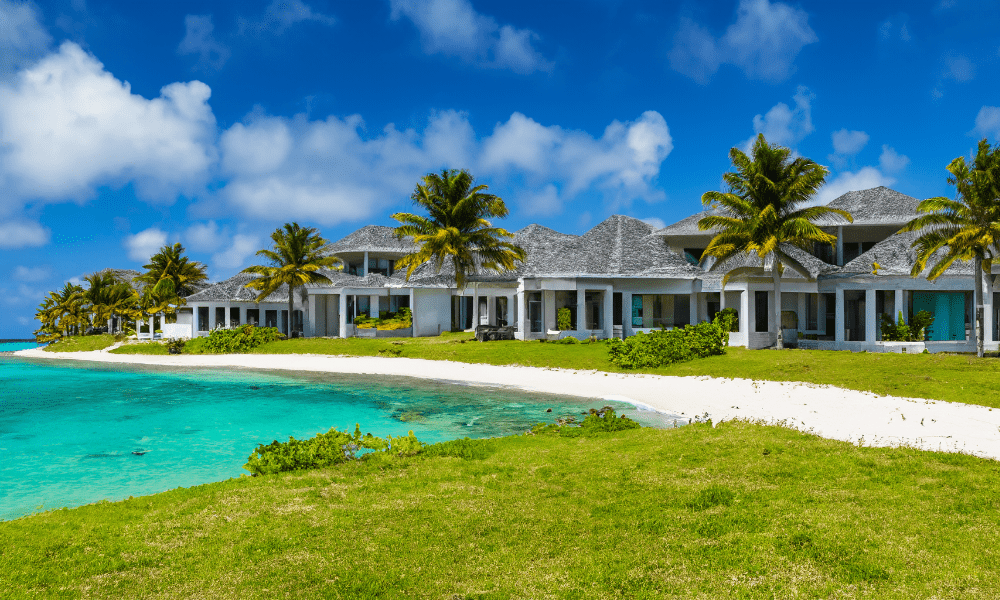

The excitement of redeeming your hard-earned credit card miles for a dream vacation can quickly deflate when you’re blindsided by fuel surcharges. These pesky fees can turn a “free” ticket into an unexpected hit to your wallet. But fear not, young American travelers!

What Are Fuel Surcharges?

Fuel surcharges, also known as carrier-imposed fees, are additional costs that airlines tack onto the base fare of a ticket. Originally introduced as a way for airlines to offset volatile fuel prices, these fees persist even when oil costs dip, often serving as an extra revenue stream for carriers.

Why Should You Care?

When you’re redeeming miles, especially for international travel or business and first-class tickets, fuel surcharges can add hundreds, if not thousands, of dollars to your “free” ticket. The key is to understand how these surcharges work and which strategies can help you avoid them.

Credit Card Points vs. Airline Miles: A Quick Primer

Before we dive in, let’s clarify the difference between credit card points and airline miles. Credit card points are earned through general spending and can often be transferred to various airline loyalty programs. Airline miles are specific to an airline’s loyalty program and are typically accrued through flying or spending on co-branded credit cards.

This is How You Will Spot Chances

When booking a flight with miles, always look for a breakdown of taxes and fees. The total you see isn’t just government taxes; it often includes fuel surcharges. These can be labeled as “YQ” or “YR” on your ticket receipt.

check it out too

- Home Coffee Brewing: Exploring Temperatures and Flavor

- Cars Buying Strategies: New vs. Used vs. Leasing

- Optimizing Rewards with Platinum, Gold, and Everyday Cards

Credit – Tips for Dodging Fuel Surcharges

- Choose the Right Airline Program: Some airlines have lower or no fuel surcharges. Knowledge is power, so research which programs offer the most favorable conditions.

- Book with Partner Airlines: If your airline has high fees, book your award ticket through one of their partners. This can often result in lower or even no surcharges.

- Keep an Eye on Fuel Prices: Surcharges can fluctuate with fuel prices. If oil prices drop, watch for airlines to potentially lower their fees, and strike while the iron is hot.

Real-Life Applications Credit: Avoiding the Extra Charge

Let’s look at some real-life tactics to sidestep these additional costs:

- Transfer Points: Instead of using airline miles that come with hefty fees, transfer your credit card points to an airline partner with lower or no surcharges.

- Redemption Sweet Spots: Certain redemptions offer more value. For example, using American Express points to book flights on ANA via the Virgin Atlantic program can save you hundreds in fees.

- Off-Peak Travel: Flying during off-peak times can not only save you miles but also reduce surcharges on some carriers.

- Direct Bookings: Sometimes booking directly through the airline’s website, as opposed to third-party sites, can result in lower fees.

The Bottom Line

Navigating fuel surcharges when using credit card miles for flights can be tricky, but with the right knowledge and tactics, you can minimize these costs and maximize the value of your points. The key is to research, plan, and stay flexible with your travel arrangements. By keeping these tips in mind, you’ll be better equipped to tackle these hidden fees head-on and soar through your travel rewards journey without the extra baggage of unexpected costs.

Remember, the goal is to travel smart, not hard. With a strategic approach to credit card miles and an understanding of the landscape of fuel surcharges, the world is yours to explore—without breaking the bank.