Navigating the world of credit can often feel like trying to solve a complex puzzle with pieces that just don’t seem to fit. But there’s one piece that can change the entire picture: your FICO score.

It’s more than a number—it’s a key that can unlock doors to your financial dreams or keep them firmly closed. And if you’re among the vibrant, ambitious 25 to 45-year-olds in America today, understanding and enhancing your FICO score is crucial for securing your future.

Why Your FICO Score Matters

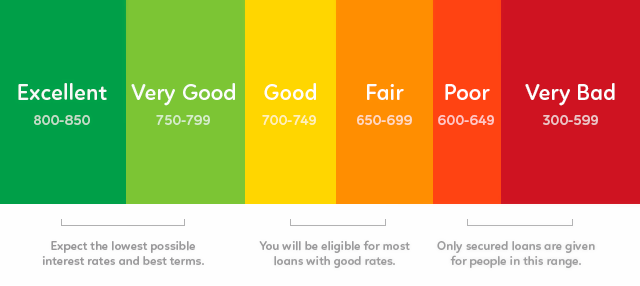

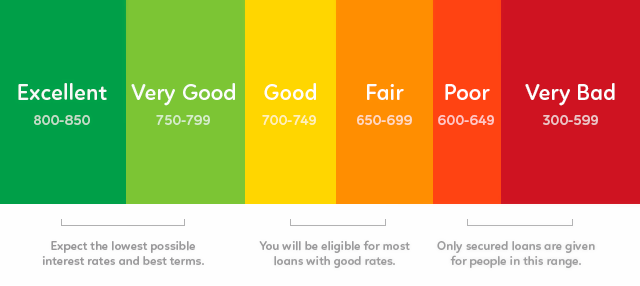

Let’s start with the basics. Your FICO score, named after the Fair Isaac Corporation that created it, is a three-digit number ranging from 300 to 850. Lenders use this score to assess how risky it may be to lend you money. The higher your score, the less risk you pose, which can lead to better loan terms—lower interest rates, more borrowing options, and a smoother approval process.

The Anatomy of Your FICO Score

Your FICO score is composed of five components, each with its own weight:

- Payment History (35%): Do you pay your bills on time?

- Amounts Owed (30%): How much credit are you using compared to what you have available?

- Length of Credit History (15%): How long have you been using credit?

- Credit Mix (10%): What types of credit do you have (credit cards, mortgage, auto loans, etc.)?

- New Credit (10%): How often are you applying for new credit?

Simple Strategies to Boost Your Score

Now, let’s dive into the actionable steps you can take to bolster your FICO score and charm lenders into offering you those sweet, sweet loan terms.

- Pay On Time, Every Time: It might seem obvious, but even one missed payment can ding your score. Set up reminders or automate your payments to ensure punctuality.

- Keep Balances Low: High balances can signal to lenders that you’re overextended. Aim to use less than 30% of your available credit on any card.

- Be Patient With Your Credit: The longer your credit history, the better. Keep older accounts open, even if you don’t use them often, to extend your credit history.

- Diversify Your Credit: A mix of credit types can show you’re capable of managing various credit lines. Just don’t overextend yourself—apply for new credit lines only as needed.

- Limit Hard Inquiries: When you apply for credit, a lender will perform a “hard inquiry” on your report, which can lower your score. Apply for new credit sparingly.

Monitoring and Maintenance

Regularly check your credit report for inaccuracies. You’re entitled to a free report from each of the three major credit bureaus—Experian, TransUnion, and Equifax—once a year through AnnualCreditReport.com. Dispute any errors you find to keep your score accurate and reflective of your true creditworthiness.

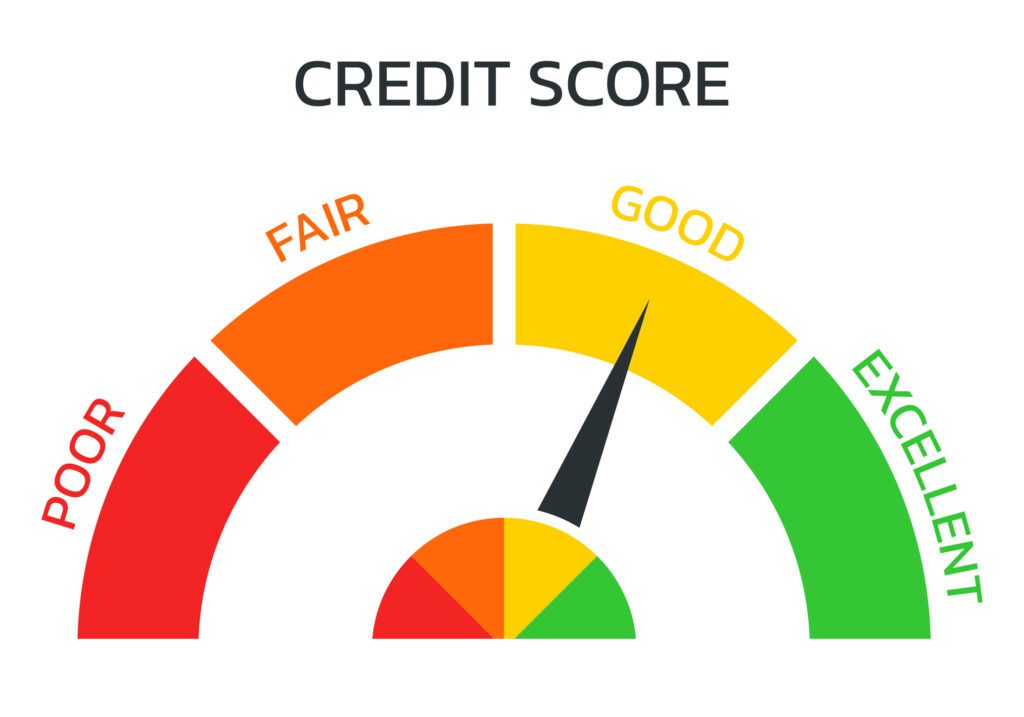

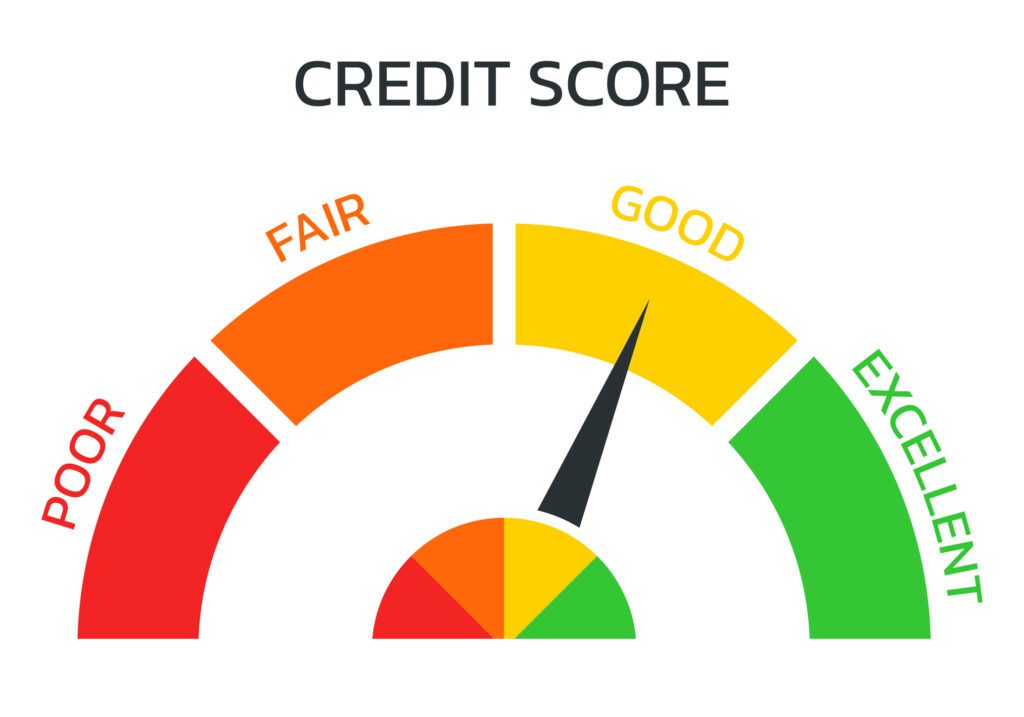

Visualizing the Impact

Imagine this: two individuals walk into a bank to apply for a loan. One has a FICO score of 650, while the other boasts a 750. The latter not only gets approved more quickly but also receives a lower interest rate, which could save thousands over the life of the loan. That’s the power of a strong FICO score.

Conclusion

Your FICO score is a small number with a massive impact on your financial health. By following the strategies outlined above, you’re not just improving a number—you’re opening up a world of financial opportunities. Stay informed, stay diligent, and watch as those three digits help pave the way to your financial success.

Remember, financial literacy isn’t about how much money you have—it’s about how well you manage it. And managing your FICO score is a fantastic place to start. Keep learning, keep growing, and let your credit unlock potential you never knew you had.

[Bullet Point Summary]

- Your FICO score affects your loan terms.

- It’s calculated using payment history, amounts owed, length of credit history, credit mix, and new credit.

- Boost your scores by paying on time, keeping balances low, having a lengthy credit history, diversifying your credit, and limiting hard inquiries.

- Regularly check your credit report for accuracy.

- A high FICO score equals better loan terms and savings.

Stay savvy, stay credit-smart, and let your FICO score do the hard work for you.

check it out too

- Mastering the art of the credit card hustle

- Insurance Policies You Shouldn’t Skimp On

- The Middle-Class Homeowner’s Guide to Refinancing